Futures Market Making

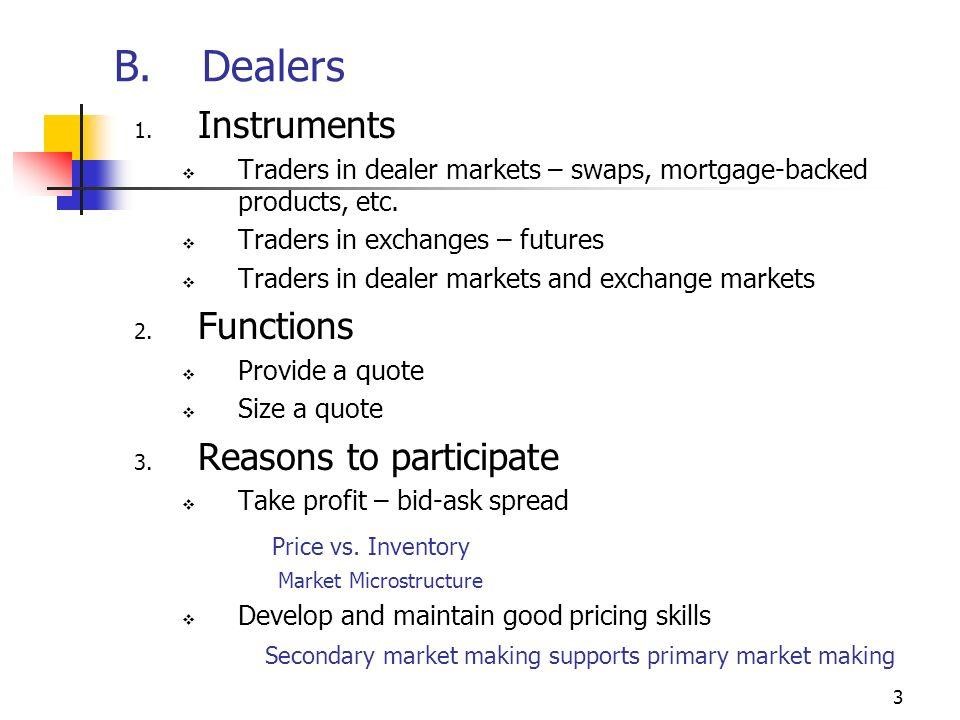

A market maker provides liquidity in the futures and options markets. A market maker must meet certain requirements to provide this service. These include a strong capital base, the ability to furnish competitive bids, and an appropriate level of risk monitoring. There are a number of market makers, and it’s important to understand how these companies operate.

The concept of market making dates back to ancient Greece, when the philosopher Thales used the futures markets to speculate on how the olive crop would fare. Today, futures contracts are traded in commodities such as wheat, corn, soybeans, hogs, and cattle. Other commodities traded on futures exchanges include coffee, orange juice, sugar, and cotton. These commodities account for a large share of global trade.

The CFFEX introduced a CGB futures market-making mechanism on May 16, 2019. Since then, market makers have played an important role in the improvement of liquidity, pricing efficiency, and market stability. In addition, the new management structure of the exchange has fostered a multi-tier market maker community.

Gedik Investment, a leading investment banking advisory firm in Turkey, has selected Horizon to provide futures market making and trade Execution solutions to its clients. Gedik has an experienced trading team that strives to be the best in the market. Horizon is a market maker, and Damien Jenner, a managing director of Horizon, is the company’s managing director. Gedik Investment’s parent company is listed on the Istanbul Bursa.