Mohawk Industries: A Solid Prospect With Some Upside (NYSE:MHK)

SERSOL

Though many people may not give it a second thought, flooring is incredibly important in this modern era. Not only are there stylistic aspects to it that hope to relay a certain message to those walking on it, there are also other important considerations to keep in mind such as the impact that the type of flooring you have will have on safety, energy efficiency, and more. One company that excels in this space is Mohawk Industries (NYSE:MHK). In recent years, the fundamental performance of the company has been rather mixed. But during the 2021 fiscal year and, so far, the 2022 fiscal year, the overall trajectory from a sales perspective has been positive. The company has struggled some from a profitability perspective. But on the whole, shares of the enterprise are trading quite cheaply. This is true both on an absolute basis and relative to similar firms. Now, I wouldn’t go so far as to say that this is a great long-term prospect that will generate tremendous upside. But given how cheap shares are and the fact that the company continues to generate significant cash flow, I do think that it does offer some nice upside potential moving forward.

Mixed results, but cheap shares

As I mentioned already, Mohawk Industries focuses on manufacturing and selling flooring to customers across the globe. The company does this for both residential and commercial spaces. And it does it using its vertically integrated manufacturing and distribution processes that it believes provide it a competitive advantage in the manufacture of carpet, rugs, ceramic tiles, laminate, wood, stone, luxury vinyl tile, and sheet vinyl flooring. The company owns a number of key brands, such as Mohawk, Pergo, American Olean, Daltile, Durkan, Quick-Step, and many others. Although the company is a global player, 60{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of its revenue during its latest completed fiscal year came from the U.S. market.

To best understand the company, we should break down its three core operating segments. The first of these is referred to as the Global Ceramic segment. Through this, the company produces and distributes a broad line of ceramic, porcelain, and natural stone tile products that are used for floor and wall applications. This includes uses in new construction and remodeling activities. For the most part, this segment sells its products through company-owned and franchised operations, independent distributors, home centers, floor covering retailers, ceramic specialists, and a number of other vital parties. Last year, this segment accounted for 35{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of the company’s revenue and for 29.2{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of its profits.

Next in line, we have the Flooring North America segment. This is responsible for the production and sale of floor covering products in a variety of colors, textures, and patterns for residential and commercial remodeling and new construction channels. Examples of flooring include, but are not limited to, carpet, carpet tile, rugs, laminate, wood flooring, and sheet vinyl. Just like the Global Ceramic segment, Flooring North America sells its products through a variety of channels, including mass merchants, department stores, e-commerce retailers, and many other parties. Last year, it was responsible for 37{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of the company’s revenue but for 29.5{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of its profits. And finally, we have the Flooring Rest of the World segment. It provides the same kind of products, such as laminate, sheet vinyl, wood flooring, and other related offerings, to its customers around the world. It’s also responsible for manufacturing roofing panels, insulation boards, mezzanine flooring, and chipboards, mostly for customers in Europe. This segment accounted for 28{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of the company’s revenue but for an impressive 41.3{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of its profits last year.

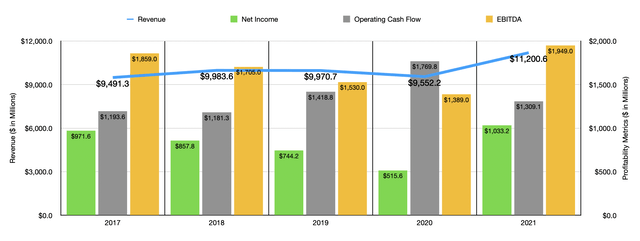

Author – SEC EDGAR Data

Over the past five years, the financial trajectory seen by Mohawk Industries has been a bit mixed. During the period from 2017 to 2018, for instance, sales rose from $9.49 billion to $9.98 billion. The next two years saw sales declines, with the biggest being in 2020 because of the COVID-19 pandemic. That year, revenue came in at $9.55 billion. Fortunately for investors, this decline was short-lived. During the firm’s 2021 fiscal year, sales skyrocketed to $11.20 billion. This surge in sales was driven by a couple of factors. First and foremost, price and product mix changes impacted sales favorably to the tune of $792 million. This was likely driven in large part by inflationary pressures. However, this did not stop customers from ordering more of the products the company has. Higher volumes contributed $739 million to the company’s top line growth. Meanwhile, foreign currency fluctuations helped in the amount of $160 million. But this was offset some by a $42 million hit associated with one less shipping day in 2021 compared to 2020. It is worth noting that the strongest growth for the company came from its Flooring Rest of the World segment, with revenue there skyrocketing by 25.4{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} because of the same aforementioned causes.

On the bottom line, the picture for the company has looked similar to the top line. Net income fell year after year between 2017 and 2020, dropping from $971.6 million to $515.6 million. In 2021, however, profits soared to $1.03 billion. Other profitability metrics have also been rather volatile. There has been no real trend for operating cash flow. However, between 2017 and 2020, it did manage to increase from $1.19 billion to $1.77 billion. Though in 2021, it did drop to $1.31 billion. EBITDA has more closely mirrored the path that net income saw. This metric fell consistently between 2017 and 2020, declining from $1.86 billion to $1.39 billion. but then, in 2021, the metric came in strong at $1.95 billion. Clearly, although the company did experience inflationary pressures, this did not stop it from passing more than those costs onto its customers.

Author – SEC EDGAR Data

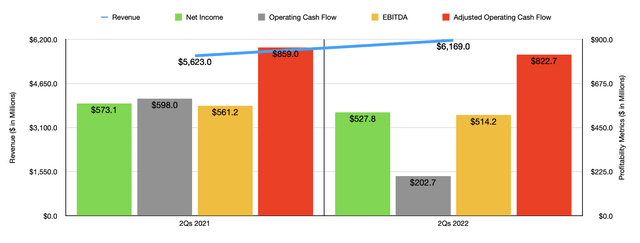

So far, the 2022 fiscal year is looking somewhat mixed. Sales for the first half of the year came in at $6.17 billion. That does represent an increase of 9.7{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} compared to the $5.62 billion generated the same time last year. Pricing and product mix helped push sales up here by $918 million. But this time, the company seems to have gone a bit too far. That is because lower volume impacted the company in a negative way to the tune of $133 million. The company was also hit in the amount of $211 million by foreign currency fluctuations and it suffered to the tune of $32 million because of one fewer shipping day relative to the same time last year.

Although revenue has risen nicely, profitability has been something of an issue. Net income in the first half of the year came in at $527.8 million. That’s down from the $573.1 million generated the same time last year. Inflationary pressures, including higher gas prices and constrained supply throughout Europe, have resulted in softening demand expectations moving forward. Management also expects that this will negatively affect its margins. To offset this, management is intending to introduce higher-value products and to focus more on its services in order to expand sales. The firm is also working on some cost savings initiatives that should reduce expenses by between $35 million and $40 million on an annual run-rate basis. This will have cash costs of $15 million to $20 million, with total costs of between $90 million and $95 million. Other profitability metrics have also shown signs of weakness. Operating cash flow went from $598 million in the first half of 2021 to $202.7 million the same time this year. Even if we adjust for changes in working capital, it would have fallen from $859 million to $822.7 million. Meanwhile, EBITDA for the company also declined, dropping from $561.2 million to $514.2 million.

When it comes to the 2022 fiscal year as a whole, management has not really provided any detailed guidance. We do know that the company should be positively impacted by acquisitions though. In particular, the company announced, in June of this year, its decision to acquire Vitromex, a ceramic tile business, from Grupo Industrial Saltillo in a deal valued at $293 million. That particular entity alone generates annual revenue of $204 million and the transaction is forecasted to close sometime in the second half of this year. Total acquisitions announced during the second quarter of this year alone came out to $440 million. So this should help to offset the company’s organic revenue issues to some degree.

Author – SEC EDGAR Data

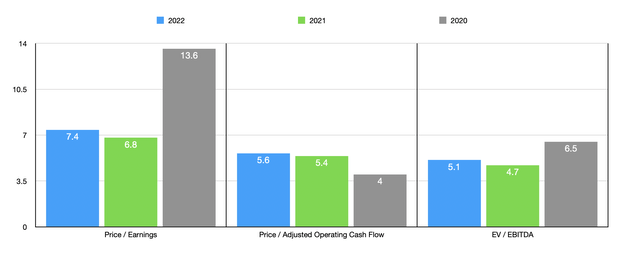

Since we don’t have any guidance, one thing that I did do was annualize results experienced during the first half of the year. Doing this, we end up with net income of $951.5 million. Operating cash flow would be $1.25 billion, while EBITDA would come out to $1.79 billion. These numbers give us a forward price to earnings multiple of 7.4, a forward price to operating cash flow multiple of 5.6, and an EV to EBITDA multiple of 5.1. These numbers are worse than what the company achieved in 2021 but they are mixed compared to 2020 results. But even if we see the company take a step back in terms of profitability, it’s difficult to imagine shares looking overvalued. Also, as part of my analysis, I compared the business to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.8 to a high of 13.9. Using the price to operating cash flow approach, the range was from 7.1 to 20.6. In both scenarios, our prospect was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was from 5.1 to 9.3. In this case, one company tied with Mohawk as the cheapest.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Mohawk Industries | 7.4 | 5.6 | 5.1 |

| Leggett & Platt (LEG) | 13.9 | 13.6 | 9.3 |

| Tempur Sealy International (TPX) | 9.5 | 7.1 | 8.2 |

| La-Z-Boy (LZB) | 8.0 | 8.3 | 5.9 |

| Ethan Allen Interiors (ETD) | 7.8 | 8.6 | 5.1 |

| The Lovesac Company (LOVE) | 10.1 | 20.6 | 7.0 |

Takeaway

At this point in time, I understand why investors might be cautious. The fact of the matter is that management expects continued inflationary pressures and other concerns to negatively impact results. Having said that, shares look incredibly cheap, both on an absolute basis and relative to similar players. Yes, the company has had a mixed operating history in prior years. But there’s no evidence yet that it will return back to those kinds of results. But even if it does, shares would still look attractively priced in most respects. For all of these reasons, I’ve decided to rate the business a ‘buy’ at this time, reflecting my belief that it will likely outperform the broader market for the foreseeable future.