2 Retail Stocks to Consider Buying Before Earnings

Retail stocks have had a difficult week following Home Depot’s (HD) and Walmart’s (WMT) underwhelming guidance despite both companies beating bottom-line expectations in their quarterly reports a few days ago.

Still, there is plenty of opportunity amongst the broader Zacks Retail and Wholesale sector. Here are two stocks investors may want to consider buying with earnings approaching.

Ross Stores (ROST)

First up is Ross Stores, which is set to report its fourth-quarter earnings on Tuesday, February 28. As an off-price retailer of apparel and home accessories, Ross Stores has found a niche among the Retail-Discount Stores Industry which is currently in the top 31{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} of over 250 Zacks Industries.

Ross Stores stock currently sports a Zacks Rank #2 (Buy) in correlation with earnings estimates trending slightly higher for fiscal 2024 as the company wraps up its FY23.

Image Source: Zacks Investment Research

Q4 Preview & Outlook

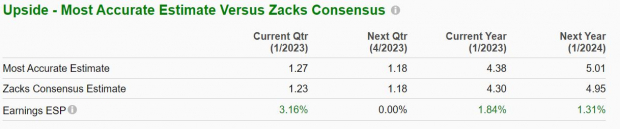

Ross Stores Q4 earnings are expected at $1.23 per share, up 18{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} from EPS of $1.04 in Q4 2022. Plus, the Zacks Expected Surprise Prediction (ESP) indicates Ross Stores could beat bottom-line expectations with the Most Accurate Estimate having Q4 EPS at $1.27. On the top line, fourth-quarter sales are expected to be $5.13 billion, a 2{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} increase from the prior year quarter.

Image Source: Zacks Investment Research

Ross Stores is now expected to round out Fiscal 2023 with earnings down -12{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} at $4.30 per share compared to EPS of $4.87 in 2022. However, FY24 earnings are expected to rebound and jump 15{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} to $4.95 a share.

On the top line, total sales are now forecasted to dip -1{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} in FY23 but rise 7{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} in FY24 to $19.86 billion. More impressive, fiscal 2024 would be 32{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} above pre-pandemic levels with 2019 sales at $14.98 billion.

Performance & Valuation

Despite being down -4{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} year to date, Ross Stores stock is still up +23{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} over the last year to largely outperform the S&P 500’s -8{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} and the Retail-Discount & Variety Markets -4{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827}. Even better, over the last decade, ROST is now up +282{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} to easily top the benchmark and roughly match its Zack Subindustry’s +292{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827}.

Image Source: Zacks Investment Research

Furthermore, at its current levels, Ross Stores stock is still intriguing going into its quarterly report. Trading at $111 per share, ROST trades at 22.8X forward earnings which is near the industry average of 21.8X. Ross Stores stock also trades well below its decade-long high of 84.3X and closer to the median of 21.2X.

Urban Outfitters (URBN)

Another retail stock that looks intriguing going into its Q4 earnings report on February 28 is Urban Outfitters. The fashion apparel retailer also sports a Zacks Rank #2 (Buy) going into the quarterly release with earnings estimates rising for fiscal 2024 as the company rounds out FY23.

This is a good sign that Urban Outfitters apparel, accessories, footwear, home décor, and gift products are continuing to attract consumers despite inflation and a pullback in non-essential spending.

Image Source: Zacks Investment Research

Q4 Preview & Outlook

The Zacks Consensus for Urban Outfitters’ Q4 earnings is $0.39 per share, down -5{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} from Q4 2022. Sales for the quarter are expected to be $1.36 billion, up 2{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} from the prior year quarter.

Rounding out its fiscal year 2023, Urban Outfitters’ earnings are now forecasted to drop -44{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} to $1.75 a share followng a stellar year that saw EPS at $3.13 in 2022. However, fiscal 2024 earnings are expected to rebound 31{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} to $2.29 per share.

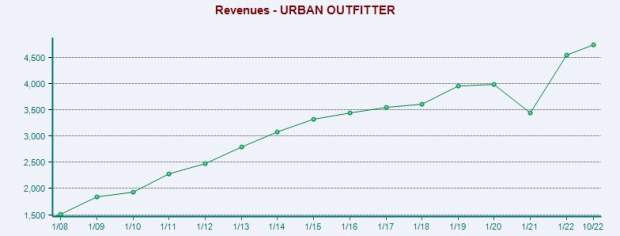

Sales are now projected to be up 5{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} in FY23 and rise another 3{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} in FY24 to $4.93 billion. Fiscal 2024 would represent 25{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} growth from pre-pandemic levels with 2019 sales at $3.95 billion.

Image Source: Zacks Investment Research

Performance & Valuation

Urban Outfitters stock has rallied +10{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} YTD to slightly outperform the broader indexes and the Retail-Apparel/Shoe Markets +9{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827}. Urban Outfitters -35{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} performance over the last decade has significantly trailed the benchmark but topped its Zacks Subindustry’s -58{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827}.

Image Source: Zacks Investment Research

With that being said, Urban Outfitters’ performance over the last year has outpaced the benchmark and its Zacks Subindustry and this could continue when looking at the company’s valuation.

Trading at $26 per share, Urban Outfitters stock trades at just 11.5X forward earnings and nicely below the industry average of 13.3X. Plus, Urban Outfitters stock trades 94{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} below its decade high of 197X and at a 26{6b977529af4b490fe19a3f85472c6203ccfa467a56646e317a890c6580e8b827} discount to the median of 15.5X.

Bottom Line

Rounding out their fiscal 2023, Ross Stores and Urban Outfitters stock look attractive from a P/E valuation standpoint relative to their past along with earnings estimates rising for fiscal 2024. This is a positive sign that both companies may be able to offer better-than-expected guidance which has been crucial for more upside in retail stocks as high inflation is still affecting consumers.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.